Our People

Our Business

Our Products

Sustainability

About Us

News

Contact

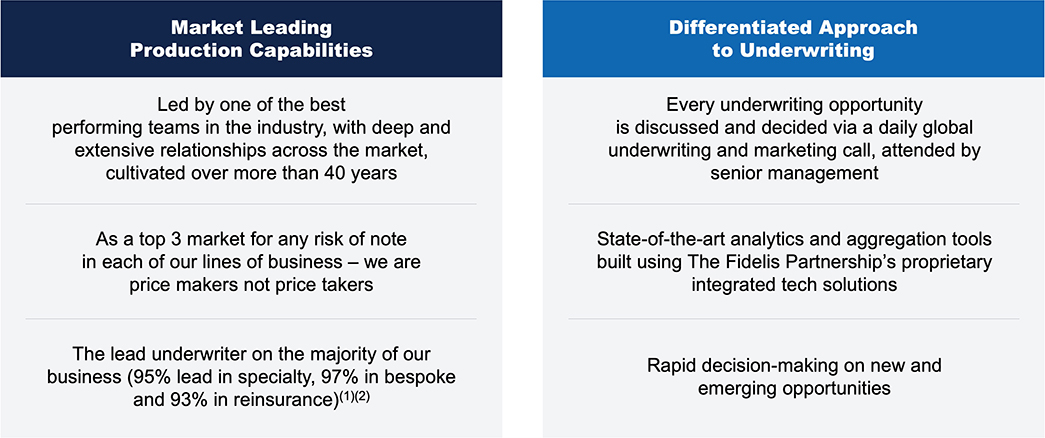

We are nimble. We are creative. And we leverage our experience through multiple platforms to provide our business partners with bespoke, cutting-edge solutions. We guarantee innovative insurance and reinsurance solutions, rapid decision-making and the ability to respond fast to an ever-changing world.

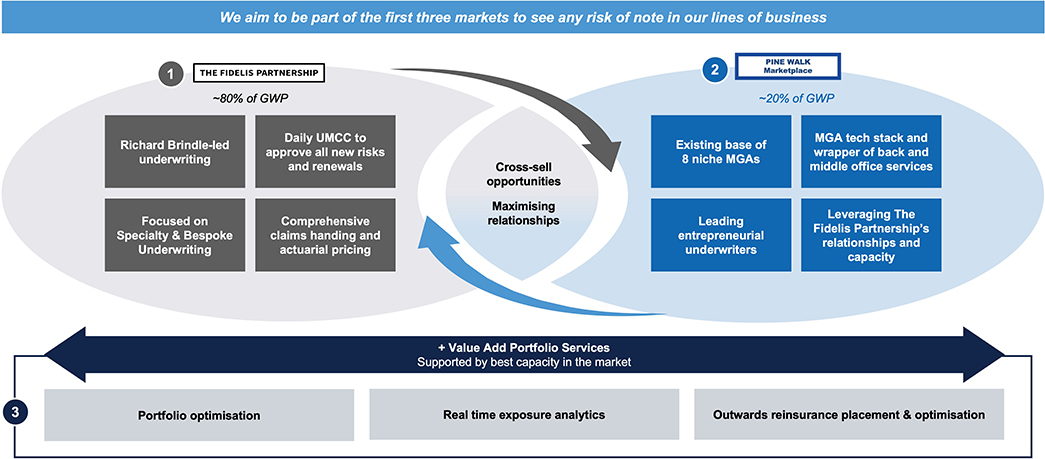

The Fidelis Partnership has three segments:

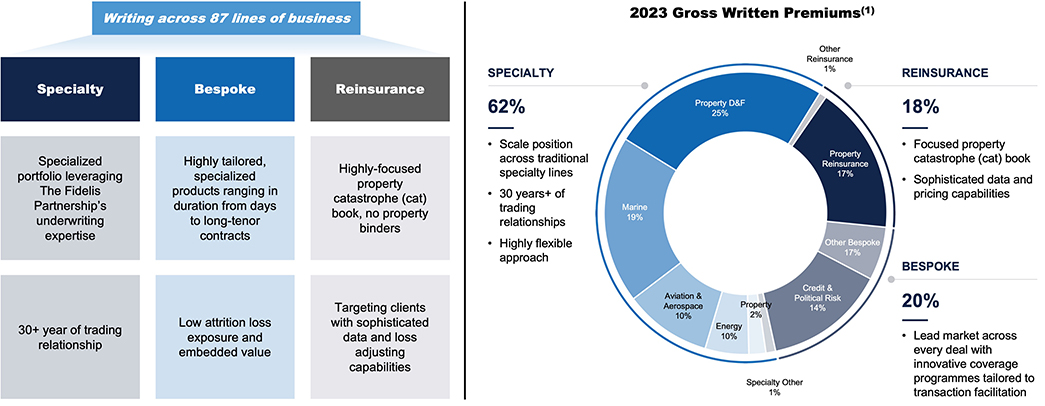

Fidelis Underwriting, comprising our three underwriting units: Bespoke, Specialty and Reinsurance.

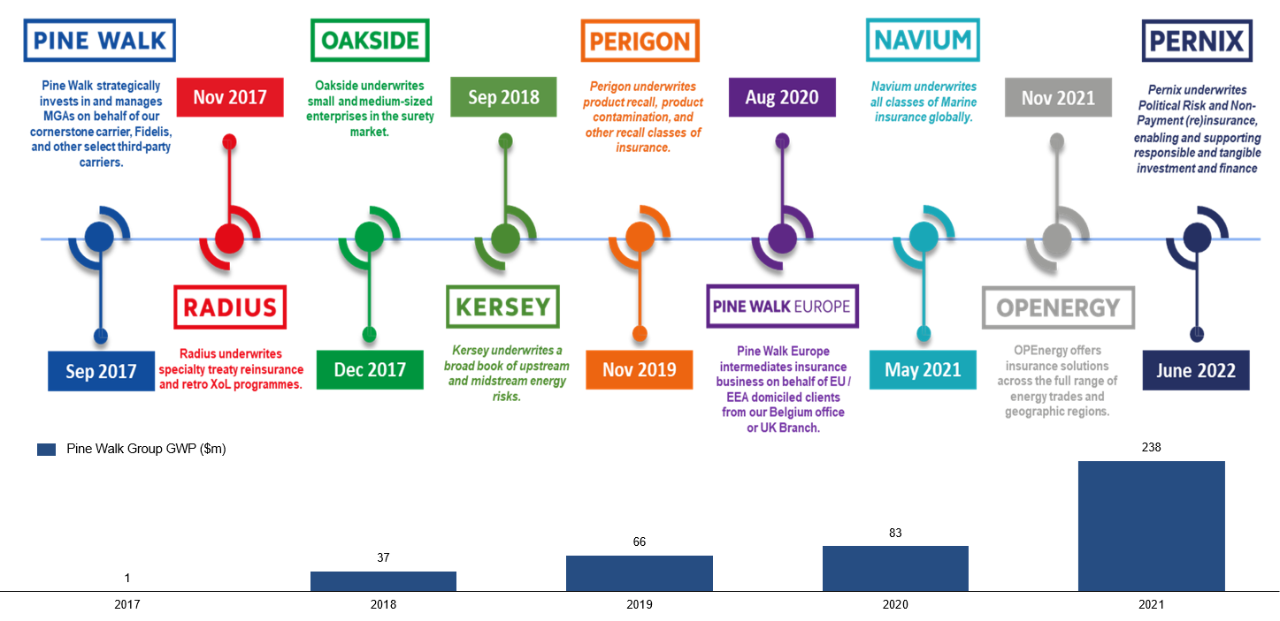

Our Pine Walk platform, which funds, owns and provides capacity and administration services to underwriter-led MGA cells in specialist niches.

Portfolio management services, where we provide a full suite of market-leading services from outwards reinsurance, claims handling and exposure management to portfolio analytics and compliance.

This is what it looks like to be more than a regular MGU. And all of this is supported by the provision of capacity from the Fidelis Insurance Group (AM Best: A (Excellent) rating) and Quota Share partners.

(1) YTD signed premium as at 22 March 2024

(2) The Fidelis Partnership defines a lead as a Entity that is define as one or more of the following elements: Claims Lead, Slip Lead, Claims Agreement Party, Price Lead, Agreement Party to Special Acceptance, and Agreement Party to Contract Changes.

(1) As reported by Fidelis Insurance Holdings Limited in its financial results for year ended December 31, 2023

Pine Walk provides Pine Walk cells access to capacity, funding and a suite of back office services.